Welcome to the world of budgeting! If you’ve been looking for a simple and effective way to manage your finances, the 50/30/20 budget method might just be your saving grace. This budgeting approach provides a clear framework for allocating your income and helps you achieve financial stability while still enjoying some well-deserved fun. In this beginner’s guide, we’ll walk you through the basics of the 50/30/20 budget method and show you how to get started on your path to financial success.

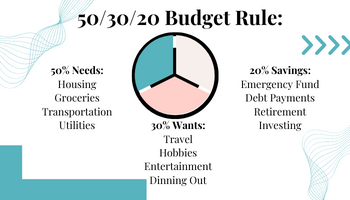

Understanding the 50/30/20 Budget Method: The 50/30/20 budget method is all about finding balance. It breaks down your after-tax income into three main categories: needs, wants, and savings. Here’s a breakdown of each category:

- Needs (50% of Your Income): This category includes essential expenses that are necessary for your day-to-day life. Think of your rent or mortgage payments, utility bills, groceries, transportation costs, and insurance premiums. These are the non-negotiable expenses that you need to cover to maintain a comfortable lifestyle.

- Wants (30% of Your Income): This category is all about guilt-free spending on things that bring you joy and enhance your quality of life. It covers discretionary expenses such as dining out, entertainment, travel, hobbies, and shopping. This portion of your budget allows you to indulge in the things you love without feeling deprived.

- Savings (20% of Your Income): The savings category is where you lay the foundation for your financial future. Allocate 20% of your income toward building an emergency fund, paying off debts, saving for retirement, and investing. This category is crucial for long-term financial security and achieving your goals.

Getting Started with the 50/30/20 Budget Method: Now that you understand the basic concept, it’s time to put the 50/30/20 budget method into action. Here’s a step-by-step guide to help you get started:

- Calculate Your After-Tax Income: Start by determining your monthly after-tax income. This is the amount you receive in your bank account after deductions such as taxes, healthcare contributions, and retirement contributions.

- Divide Your Income into Categories: Allocate 50% of your income to your needs, 30% to your wants, and 20% to savings. Use a budgeting tool or spreadsheet to keep track of your allocations.

- Identify Your Needs: List your essential expenses under the needs category. This includes rent or mortgage payments, utilities, groceries, transportation costs, insurance premiums, and minimum debt payments.

- Determine Your Wants: Under the wants category, list the discretionary expenses that bring you joy and enhance your lifestyle. This can include dining out, entertainment, travel, hobbies, and shopping. Remember, it’s important to enjoy life while staying within your budget.

- Set Up Automated Savings: Automate your savings by setting up automatic transfers to a separate savings account or retirement fund. This ensures that you prioritize your financial future without relying on willpower alone.

- Track and Adjust: Regularly review your spending and make adjustments as needed. Stay mindful of your budget and find creative ways to cut costs or increase savings when possible. Remember, small changes can add up over time.

Tips for Success: To make the most of the 50/30/20 budget method, here are a few tips to keep in mind:

- Be Realistic: Ensure that your allocations reflect your actual income and expenses. Adjustments may be needed in the beginning as you fine-tune your budget.

- Embrace Flexibility: Life is unpredictable, and your financial situation may change. Be flexible and adapt your budget accordingly to accommodate new circumstances.

- Celebrate Milestones: As you achieve your savings goals or pay off debts, take a moment to celebrate your milestones. Rewarding yourself along the way will help you stay motivated.

- Seek Support: Consider joining online communities or forums where you can connect with others who follow the 50/30/20 budget method. Sharing experiences and learning from others can be highly beneficial.

The 50/30/20 budget method provides a straightforward approach to managing your finances and achieving your financial goals. By categorizing your income into needs, wants, and savings, you can strike a balance between enjoying your life today and building a secure future. Remember, consistency is key, so stay committed to your budget and make adjustments as necessary. With time, patience, and perseverance, you’ll find financial success and peace of mind. Happy budgeting!